Consumers are feeling the pinch as the costs of basic needs like groceries, utilities, and fresh produce continue to rise. Many are cutting back on discretionary spending, such as apparel and vacations, to prioritize essentials (1). For instance, KPMG's Consumer Pulse Summer 2025 reveals Americans plan to spend 7% less each month on restaurants this summer compared to their usual habits (2). But there's good news! Savings opportunities go beyond forgoing luxury items; there are ways to save on everyday essentials without sacrifices, and businesses can play a crucial role in helping employees stretch their budgets further.

Explore tips for saving during challenging economic times and learn how companies can support employees with financial well-being through discount and perks platforms like BenefitHub.

Rising Costs Call for Smarter Spending

The economic impact on American wallets has been stark. Consider these statistics (3):

- Grocery prices have risen 25.8% over the past four years, putting pressure on essentials.

- Average car insurance rates soared by up to 26% in just the last year, with a cost of $2,543 annually.

- A family vacation to an amusement park can now run up to $7,093 for a baseline experience.

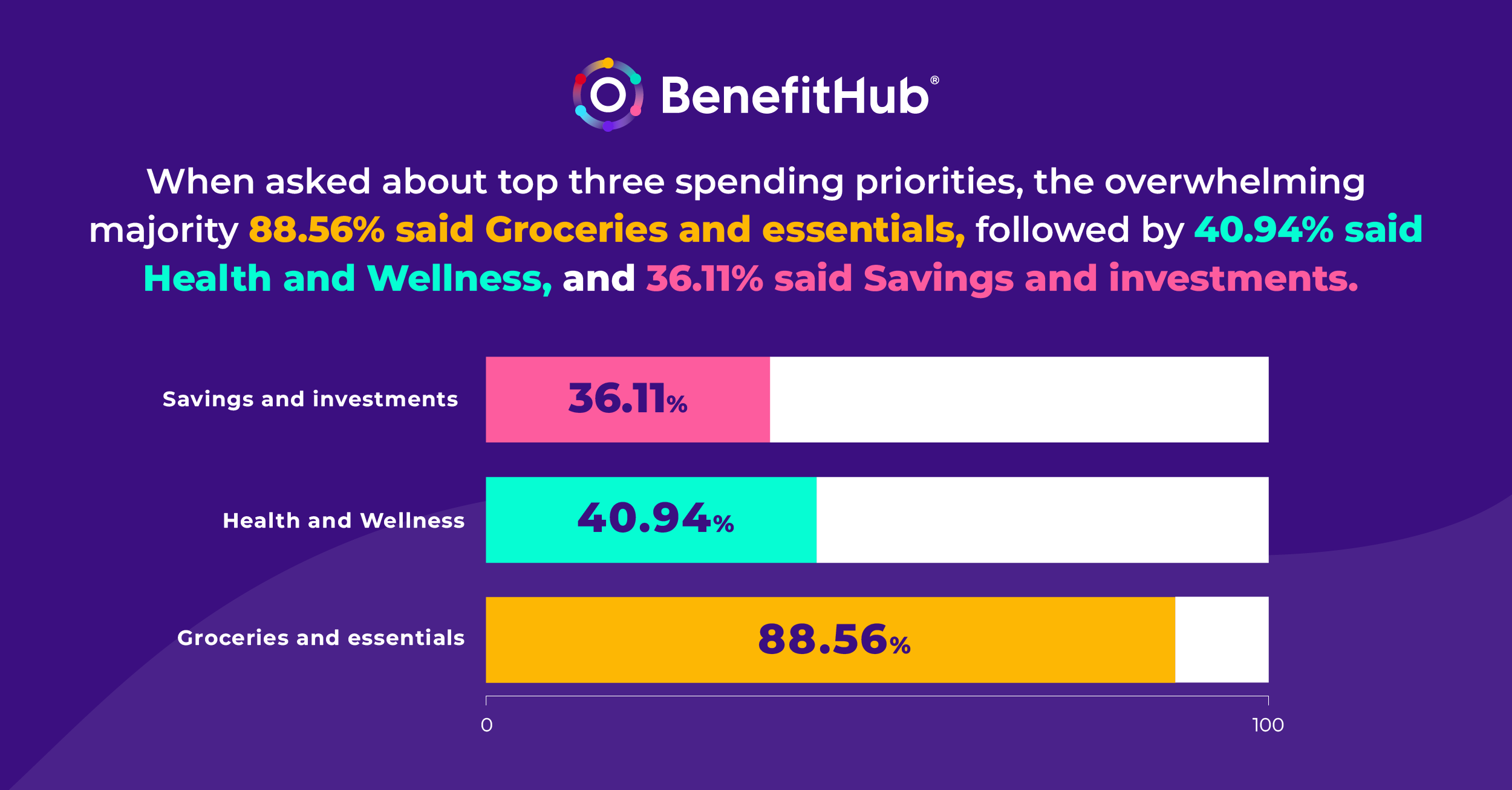

Across the board, discretionary spending is taking a back seat. BenefitHub Intelligence's own research in "Understanding Employee Sentiment in a Shifting Economy" notes that even optimistic consumers are prioritizing needs over wants, with groceries, health and wellness, and financial wellness ranking as the top three categories for spending (4).

But while cutting back seems to be the obvious solution, smart savings strategies allow individuals and employees to still enjoy meaningful experiences while managing costs.

Savings Tips for Everyday Life

A whopping 88% of Americans have changed their grocery shopping habits in response to inflation (5). However, essential spending still needs to happen, and consumers are looking for help. Here are some effective tips to make the most of every dollar while maintaining a quality lifestyle.

- Take Advantage of Discounts and Perks

Discount and perk programs, such as those offered on platforms like BenefitHub, are an excellent way to stretch your budget. Employees using BenefitHub report saving over $2,500 annually by accessing discounts on groceries, entertainment, electronics, travel, and more.

Not only do these savings impact everyday essentials, but they also apply to big-ticket purchases, making expensive items more accessible. Companies offering such benefits create a meaningful way to extend employees’ take-home pay without straining their operational budgets.

- Plan Purchases Strategically

Take the time to identify your spending priorities.

Buy in bulk for pantry staples and household essentials to save in the long term.

Use cashback offers or member-exclusive discounts when shopping for necessities.

Compare prices online and offline to ensure you get the best deal.

- Shift How You Spend on Entertainment

Entertainment costs, like movie tickets or concerts, have dramatically increased. The cost of taking a family of 4 out to the movies with popcorn has risen to nearly $100. In 2024, the average movie ticket cost is $12 - which represents a 21% increase in the last three years (3). However, trade-offs can reduce the impact on your wallet.

- Opt for local or free events to cut down on ticket prices.

- Use employer-provided perks for discounts on entertainment or family activities. BenefitHub offers up to 35% off tickets at cinemas like AMC, Regal, Cinemark, and Showcase.

- Host home movie nights as an affordable alternative to pricey theater visits. Earn cash back through streaming services like Hulu with BenefitHub.

- Track Expenses and Cut Waste

Regularly review your expenses to identify areas where you can cut back on wasteful spending. Depending on your household, this might mean eating out less often, canceling subscriptions you rarely use, or reducing electricity use.

- Engage with Financial Wellness Resources

Many employers now offer financial wellness programs and tools that help staff manage budgets more effectively. From curated budgeting tips to discounts, these resources align with cost-conscious living and are increasingly in demand.

How Employers Can Make a Difference

Employees rely on their organizations to help ease the burden of rising living costs. While traditional pay raises may be a challenge, alternative benefits can provide tangible financial value.

Offering access to platforms like BenefitHub is a win-win solution. By providing discounts on essentials and perks on major purchases, companies create a sense of care and loyalty while helping employees save meaningful amounts of money. These benefits act as a financial boost that rivals the impact of direct salary increases.

Plus, research shows that employees actually use these benefits. BenefitHub Intelligence found that 94% of employees say exclusive member discounts influence their purchasing decisions when evaluating comparable products or services, with 80% reporting these discounts regularly affect their choices (4).

Additionally, offering exclusive discounts and financial counseling services can go a long way in supporting overall employee well-being. Companies that invest in these perks are not only enhancing take-home income but also actively contributing to their team’s quality of life.

Take Control with Smarter Spending

Despite economic uncertainties, there are countless ways to manage spending without cutting back on the life experiences that matter. From leveraging discounts to strategic spending, employees and employers alike can ensure financial burdens are eased.

For businesses, the opportunity to foster financial well-being through alternative benefits is a powerful way to build trust, loyalty, and engagement with employees.

Start saving today with perks programs like BenefitHub to enjoy more for less while navigating today's challenging economic environment.

Sources:

- McKinsey, An update on US consumer sentiment: Is growing uncertainty casting a chill on spending plans?

- Fox News, Americans cut restaurant spending amid economic concerns

- “How Employers Can Use Discounts to Offer Meaningful "Raises" for Employees”

- BenefitHub Intelligence, "Understanding Employee Sentiment in a Shifting Economy"

- Food&Wine, "9 in 10 Americans Are Changing How They Shop for Groceries to Save Money - Even High Earners"