Learn about the key voluntary benefits that can help enhance employee retention efforts and keep your workforce engaged and satisfied.

Key Takeaways:

To stay competitive in the job market, companies need to find innovative ways to stand out, attract, and retain employees.

- On average, companies offer 12 Voluntary Benefits.

- 73% of employees say that a wider array of benefits would make them continue working for their current employer for longer.

- Popular Voluntary Benefits include pet insurance, wellness benefits, auto & home insurance, and more.

The Competitive Employee Landscape

In today's competitive job market, attracting and retaining top talent has become increasingly challenging. With job turnover at an all-time low with a 2.1% quit rate starting off 2024 (1), companies need to find innovative ways to stand out and attract new employees. One effective strategy is to offer a comprehensive package of voluntary benefits that go beyond the standard healthcare and retirement plans.

In 2022, the average number of voluntary benefits offered by employers was 12, compared to 10.6 in 2020 (2). 52% of employers have expanded voluntary benefits since the pandemic, and 72% plan to continue to expand offerings (2).

The Importance of Voluntary Benefits in Employee Attraction & Retention

Voluntary benefits play a crucial role in attracting and retaining employees (read more). While salary and traditional benefits are important, today's workforce is looking for additional perks that enhance their quality of life and provide peace of mind. 68% of employees agreed that voluntary benefits are an essential part of a benefits package (2), and 73% say that a wider array of benefits would make them continue at their employer for longer (3).

By offering voluntary benefits such as Pet Insurance, Student Loan Repayment Assistance, Employee Purchase Programs, Financial Coaching, Life Insurance, Auto & Home Insurance, and more, companies can cater to the diverse needs and interests of their employees.

The Impact of Voluntary Benefits on Employee Health

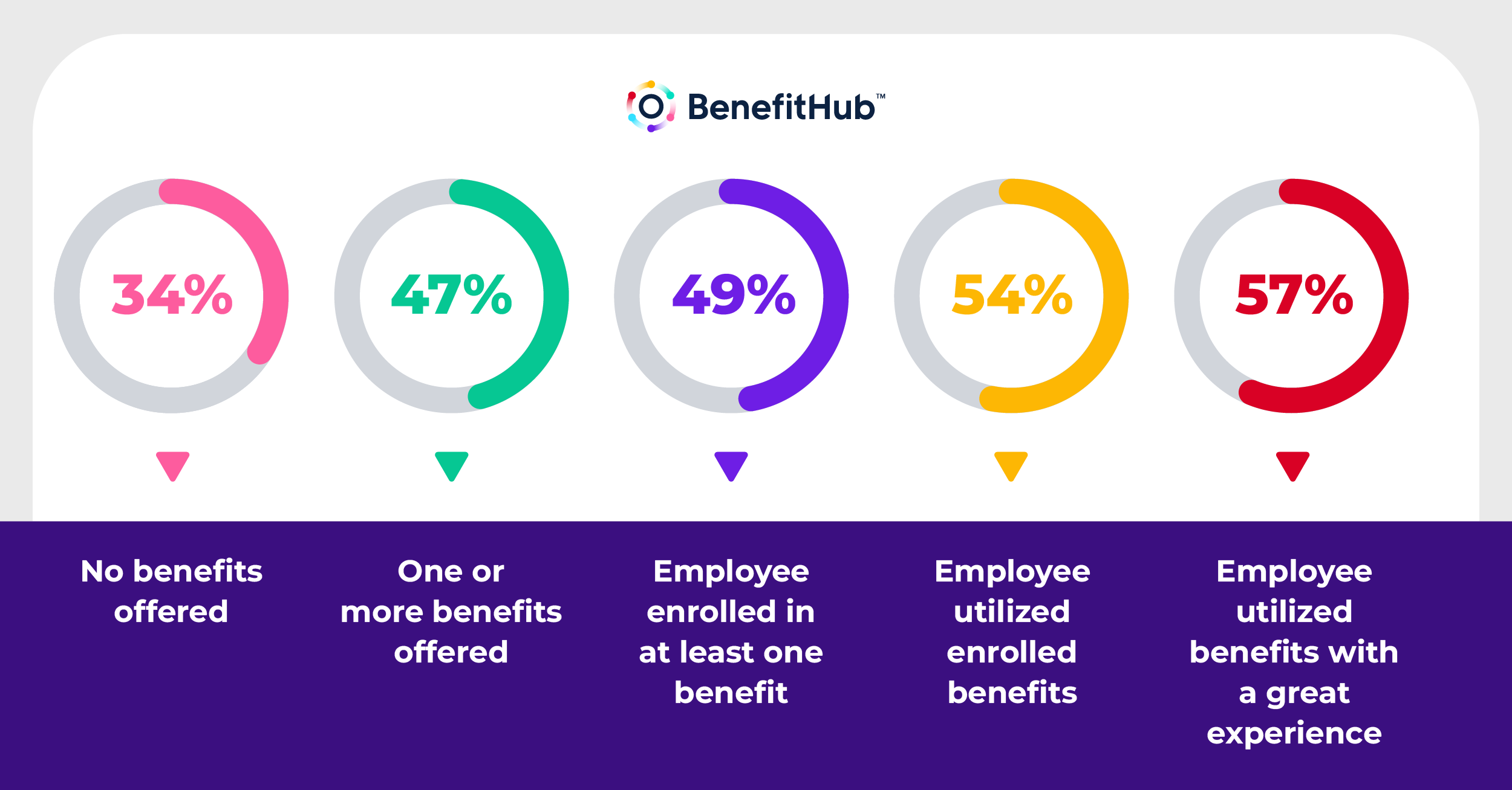

There is a positive relationship between number of benefits offered and proportion of employees who feel holistically healthy, with only 34% of employees feeling healthy with no benefits, and 57% of employees feeling healthy with "one or more benefit being utilized with a great experience" (3).

Why does this matter? Healthy employees are happy employees, and employees who use their voluntary benefits and have a good experience are 1.2x more likely to feel more productive, and more loyal (3).

Key Voluntary Benefits to Consider

When considering which voluntary benefits to offer, it's essential to select options that have broad appeal. Here are a few key voluntary benefits that have shown to be popular among employees of all ages, locations, and marital status:

- Pet Insurance: Many employees consider their pets as part of their family. Offering pet insurance can help alleviate the financial burden of veterinary care and demonstrate the company's commitment to work-life balance. According to Voluntary Advantage, "Pet insurance provides financial relief, especially since pet ownership costs can range from $2,000-$4,000 per year on average. Getting extra support from a Pet Insurance policy for veterinarian bills, test fees, and medication gives employees one less thing to worry about when caring for their furry family members" (4).

- Student Loan Repayment Assistance: With student loan debt on the rise, employees greatly appreciate assistance in managing their educational loans. Federal loan payments were paused from March of 2020 until June of 2023 due to the passage of the CARES Act, but they have resumed and are a top concern for Millennial and Gen Z employees. Did you know that the act also included a provision that allowed employers to offer up to $5,250 in student loan repayment benefits on a pre-tax basis? This is another way how employers can contribute to their employee needs.

Furthermore, with the passage of the Secure 2.0 Act, student loan payments can be incorporated into an employer’s 401(k) plan. This means that an employee can receive an employer match for each student loan payment they make, allowing an employee to receive retirement credits in their 401(k). These benefits can be a powerful tool for attracting and retaining young talent (4).

- Health & Wellbeing Benefits: such as dental insurance, vision insurance, cancer insurance, long term care, and Telehealth solutions. With cost saving discounts from the top insurance providers, BenefitHub makes it easy to purchase coverage, and get high-quality care just about anywhere.

- Financial Wellness Benefits: This includes benefits like Employee Purchase Programs, life insurance, tax preparation, financial planning & coaching, and more. With an EPP, employers can provide discounted rates on products and services from partner companies can be a valuable perk for employees, helping them save money on everyday expenses. This is one of the main ways that the BenefitHub platform provides value to employees, with the world's largest discount marketplace that can save employees over $4,900 annually on deals from thousands of leading brands.

- Auto and Home Insurance: Offering competitive rates on insurance coverage for employees' vehicles and homes can provide peace of mind and significant cost savings. BenefitHub’s Auto Insurance program offers a best-in-class quoting process that allows the employee to compare rates quickly and easily across our 17 top national insurance carriers. Employees can save over $1,092 on discounted insurance rates with BenefitHub.

- ID Protection and Legal Services: ID protection is a service that allows your people to monitor and secure their personal identity. With ID protection, your people can safeguard their information before an adverse incident occurs, and get help in case it does. BenefitHub has partnered with best-in-class identity protection carriers to ensure that your people have options in their coverage that best fit their individual needs. Plus, with a wide variety of legal solutions, BenefitHub's valued partners are on-hand to assist your people with comprehensive legal insurance, simplified legal document preparation services, and everything in between. Learn more.

How BenefitHub Can Help with Voluntary Benefits

BenefitHub is a leading provider of employee discounts and voluntary benefits solutions that can help companies enhance their employee retention efforts. BenefitHub offers a comprehensive platform that allows employees to access and manage their voluntary benefits in one place.

With BenefitHub, employees can easily explore and enroll in a range of voluntary benefits, including Pet Insurance, Long Term Care, Auto and Home Insurance, and more. The platform provides personalized guidance, educational resources, and support to help employees make informed decisions.

By partnering with BenefitHub, companies can streamline their voluntary benefits program, improve employee engagement, and strengthen employee retention. BenefitHub's user-friendly interface and dedicated customer service ensure a seamless experience for both employers and employees.

Sources:

(1): HR Brew: "January quit rate shows employees are 'nesting.' What HR needs to know"

(2): Buck 2022 Wellbeing and Voluntary Benefits Survey Report

(3): Metlife's 22nd Annual U.S. Employee Benefit Trends Study 2024

(4): Voluntary Advantage: "Key Voluntary Benefits to Bolster Retention Efforts"